Brazilian CFO gives CMU students an inside look at global agribusiness

Cristiano Machado Costa shares his career path, company growth and real-world finance insights during virtual visit to CMU finance classes.

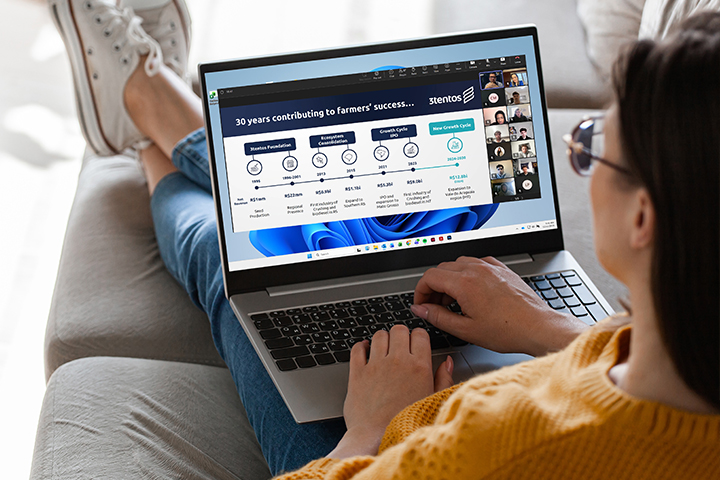

Cristiano Machado Costa, chief financial officer of 3tentos, joined Central Michigan University finance students virtually on Nov. 25 for a detailed conversation about his career, the company’s operations and the realities of managing finance in a global agribusiness.

Costa began by sharing his personal and professional background. Born and raised in Porto Alegre, Brazil, he studied economics alongside his wife, Luciana, before earning a master’s degree from Fundação Getulio Vargas and later a Ph.D. from the University of Pennsylvania. He spent five years living in Philadelphia while completing his doctoral work, with Luciana studying nearby at Drexel University.

After earning his degree, Costa returned to Brazil to teach at universities in Espírito Santo and later in his hometown, where he served as a professor in graduate accounting programs. Throughout his academic career, he also conducted consulting work and served on fiscal councils and audit committees for various organizations.

From audit committee to CFO

Costa told students that his relationship with 3tentos began when the company was preparing for its 2021 IPO and needed to establish an audit committee. He joined the committee as an independent member, helping the company meet new governance requirements. In 2023, after the company’s CFO left and a search for a successor stalled, the founders invited Costa to assume the role.

“It’s a long journey of adventures and challenges,” he said.

How 3tentos operates

Costa walked students through the company’s 30-year growth, explaining its three main lines of business: agricultural inputs, grain trading and industrial processing. The company sells seeds, fertilizers and crop protection products; receives grain through barter transactions; and processes soybeans into meal, oil and biodiesel.

He explained the company’s expansion from its origins in Rio Grande do Sul into Mato Grosso, the largest soybean-producing state in Brazil. By the end of the year, the company’s existing soybean-crushing plants will significantly expand their processing capacity, while a new corn-ethanol plant under construction in Porto Alegre do Norte is expected to come online in March, further strengthening overall production capabilities.

Costa also highlighted the company’s logistics advantages, including rail access in southern Brazil and northern export routes connected to river barges and ports.

He described the company’s research centers, which test a wide range of combinations involving soil conditions, seed varieties, fertilizers, and crop protection strategies. Each experiment helps consultants advise producers on improving yields. Costa explained that the company’s “Producer Mais” program uses treatment-and-control experiments to measure productivity gains over time.

Digital tools also play a significant role. Costa noted that the company’s app is widely used by producers to purchase inputs, sell grain, and manage transactions, including a feature that allows farmers to lock in grain prices as market conditions change.

Managing risk, governance and environmental considerations

Students asked a wide range of questions about how the company manages risk, navigates global markets, and structures its governance. Costa discussed the company’s experience going public, noting that the IPO required extensive documentation, new governance frameworks, and several years of audited financial statements.

He also addressed how global tariffs can influence operating costs and shift demand, particularly in soybean markets, which in turn affect margins for crushing operations. Oversight of these dynamics, Costa said, is supported by audit and risk committees that meet monthly to review financial statements, compliance requirements, and key performance indicators.

Environmental considerations were discussed as part of the company’s broader risk strategy. Costa explained that Brazilian law requires grain producers to comply with land-use restrictions, and that the company’s geographic diversification helps mitigate climate-related risks, as weather patterns in different regions often move in opposite directions. “There isn’t much we can do other than diversify regions,” he said.

As CFO, Costa oversees accounting, tax, payables and receivables, financial planning, derivatives used for risk management, and the financial information that supports business decision-making across the organization.

Career advice for students

Costa encouraged students to take professional risks early, build networks and seek meaningful experiences. “Knowledge and experience are cumulative throughout life,” he said. He emphasized the value of in-person work and staying connected to others, noting how opportunities often arise through everyday interactions.

The session gave CMU finance students a direct look at global agribusiness operations and the decision-making environment of a multinational company.